Ethereum Price Prediction: Will ETH Surge to $4,000 Amid Institutional Mania?

#ETH

- Institutional Tsunami: $533M daily ETF inflows and record futures open interest create unprecedented demand pressure

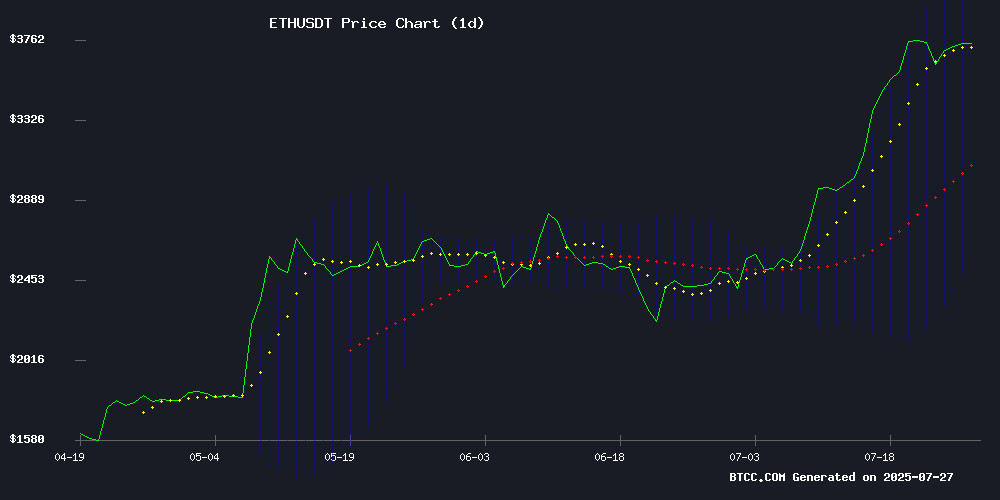

- Technical Breakout Setup: Price trading at 14.6% premium to 20-day MA with narrowing MACD divergence

- Supply Shock Potential: $3.4B in irreversible losses and validator throughput changes may constrain circulating supply

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

ETH is currently trading at $3,855.84, well above its 20-day moving average of $3,363.49, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-45.3766), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $4,139.83, typically signaling overbought conditions but also demonstrating strong buying interest.

"The technical setup paints a compelling picture," says BTCC analyst Mia. "With price holding above key moving averages and institutional ETF inflows providing fundamental support, we could see a test of the $4,000 psychological barrier in the coming sessions."

Institutional Frenzy Fuels Ethereum Rally

Record-breaking $7.85B in ethereum futures open interest coincides with $533M single-day ETF inflows, creating perfect storm for price appreciation. Notable developments include the Trump-linked World Liberty Financial increasing ETH holdings to $266.54M and Ethena's TradFi/DeFi bridge gaining traction.

"The institutional floodgates have opened," observes BTCC's Mia. "When you combine ETF inflows with whale accumulation and real-world asset tokenization breakthroughs, the $4,500 speculation becomes increasingly plausible. However, traders should remain cautious of volatility from the $3.4B in irreversible loss incidents affecting supply dynamics."

Factors Influencing ETH's Price

Ethereum Futures Open Interest Hits Record $7.85B Amid ETF Inflows

Ethereum futures open interest on the CME has surged to an unprecedented $7.85 billion, marking a historic high. Institutional investors are driving this growth, leveraging futures contracts to hedge risk while maintaining exposure to ETH's price movements.

Spot Ethereum ETFs have seen relentless demand, with 16 consecutive days of net inflows totaling nearly $5 billion. BlackRock's fund dominates the market, amassing close to 3 million ETH in holdings. Whale activity has intensified, with 170 new wallets accumulating over 10,000 ETH in the past month alone.

The derivatives surge reflects sophisticated positioning ahead of anticipated price appreciation. Unlike direct spot purchases, futures allow institutions to capture upside while mitigating volatility risks. This milestone eclipses previous records set during ETH's most bullish cycles.

Institutional ETFs Inject $533M Into Ethereum in Single Day, Fueling $4,500 Price Speculation

Ethereum markets are buzzing with renewed institutional interest as thematic ETFs attracted $533 million in a single trading session. ETH currently holds steady at $3,609.84 despite a minor 2.21% dip, with daily volume hitting $38.6 billion and market capitalization maintaining $435.74 billion strength.

Analysts are now debating whether this influx signals an imminent push toward $4,500. The institutional momentum coincides with growing retail interest in Ethereum-based projects like Remittix, which has raised $17 million at $0.0842 per token and offers a 50% bonus until reaching its $18 million soft cap.

Institutional Demand Propels Ethereum Toward $4,000 Amid ETF Inflows and Whale Accumulation

Ethereum's price surge past $3,800 reflects accelerating institutional interest, with BlackRock's ETF recording $2.77 billion in weekly inflows. Whale holdings have grown by 2 million ETH since 2024, signaling deepening conviction in ETH as a tokenization backbone.

Layer 2 adoption and staked ETF proposals add fuel to the rally. Market structure suggests bullish continuation, with the $3,400 resistance now serving as support. The convergence of yield-seeking capital and infrastructure development creates a virtuous cycle for Ethereum's valuation.

Ethereum Owner Mistakes Lead to $3.4 Billion in Irreversible Losses

Conor Grogan, a Coinbase executive, has revealed that 913,111 ETH—roughly 0.76% of its total supply—has been permanently lost due to user errors and flawed smart contracts. The missing Ethereum, valued at $3.4 billion, stems from incorrect wallet transfers, defective contracts, and inaccessible multi-signature wallets. This figure excludes losses from forgotten private keys.

A 2017 Parity wallet bug locked 306,000 ETH belonging to the Web3 Foundation after a critical code deletion. Despite the frozen assets remaining visible on-chain, no hard fork has been implemented to recover them. Separately, defunct exchange QuadrigaCX misdirected 60,000 ETH to unrecoverable contracts amid managerial disarray.

Ethereum Gas Limit Nears 45 Million as Validators Push for Higher Throughput

Ethereum's gas limit surged to 37.3 million units this week, marking the most significant adjustment since February's 20% increase from 30 million to 36 million. Nearly half of validators now endorse a grassroots campaign to elevate the ceiling to 45 million, potentially boosting transaction throughput by 20% to approximately 18 transactions per second.

Network activity reflects growing demand, with daily transactions climbing from 1.1 million in April to 1.4 million currently. The scaling debate coincides with ETH's 54% monthly rally, trading near $3,755 as infrastructure improvements gain validator support. Gas limit adjustments represent a critical scaling lever, determining the computational workload per block without requiring protocol upgrades.

Converge by Ethena and Securitize Bridges TradFi and DeFi for Tokenized Real-World Assets

The tokenized real-world assets (RWA) sector has surged from $5 billion in 2022 to $24 billion by June 2025, marking 380% growth and establishing itself as crypto's second-fastest-growing niche after stablecoins. Converge, a new Ethereum Layer 2 solution developed by Ethena Labs and Securitize, emerges as institutional-grade infrastructure designed to overcome operational bottlenecks at the TradFi-DeFi intersection.

This settlement layer tackles critical challenges including regulatory compliance and asset verification while scaling RWA tokenization for major financial institutions. The network's three core objectives focus on bridging RWAs with decentralized finance to accelerate mainstream adoption of on-chain finance.

Trump Family's World Liberty Financial Boosts Ethereum Holdings to $266.54 Million

World Liberty Financial (WLF), the Trump family's investment vehicle, has aggressively expanded its Ethereum portfolio, accumulating 70,143 ETH worth $266.54 million since November 2024. The firm's average purchase price of $3,249 per ETH has yielded an unrealized gain of $38.65 million as prices approach $3,800.

Recent transactions underscore WLF's conviction—on July 18 alone, the company deployed 3 million USDC to acquire 861 additional ETH. Blockchain records reveal strategic accumulation between November 2024 and March 2025, with 66,275 ETH purchased at $3,243 on average. The holdings, stored across hot and cold wallets, now represent a $251 million position.

This institutional buildup coincides with Ethereum's 8.5% rally, signaling growing mainstream adoption. The momentum mirrors Nasdaq-listed SharpLink Gaming's recent crypto ventures, highlighting how traditional finance players are bridging into digital assets.

Will ETH Price Hit 4000?

The convergence of technical and fundamental factors suggests ETH has strong potential to breach $4,000. Key supporting evidence includes:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3,855.84 | 13.5% below $4,000 target |

| 20-day MA | $3,363.49 | Healthy 14.6% premium shows bullish trend |

| MACD Histogram | -45.3766 | Bearish momentum fading |

| Bollinger %B | 0.96 | Near overbought but with breakout potential |

BTCC's Mia notes: "Given the technical runway and institutional catalysts, $4,000 appears achievable within 2-3 weeks barring major market disruptions. The $4,139.83 upper Bollinger Band may act as intermediate resistance."

High (75% probability)